Oh, yeah – I’m Lovin’ it!

This happens to be one of my favorite subjects in the wealth-building arsenal…

It’s close to my heart for personal reasons, that I’ll come back to later.

But first there’s a big question in my mind – and probably in yours, too – that needs to be answered.

What exactly is a franchise????

Everyone kind of understands the basics of how Burger King or McDonald’s operates, and this gets the label of “franchise” slapped on to it.

How is it, then, that within the same paradigm where Subway sandwiches can be called a franchise, so can the New York Yankees?

Or all of The Matrix sequels?

(My favorite movies, as you know).

This requires us to start with the basics, and learn what the foundation of a franchise is, then we can expand on some of the ways to get creative in redefining it.

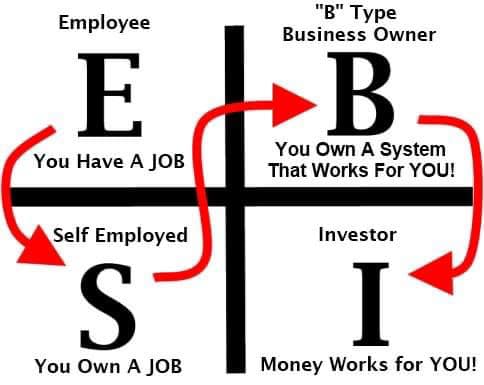

Learning from the Cashflow Quadrant

“Repetition is the Mother of all Learning!” Since it is essential for every business owner to know, the Cashflow Quadrant will be coming up more than once.

In my last blog, I touched a little bit on the differences in category from the left side of the quadrant – employee vs. self-employed.

I grew up on the left side of this quadrant.

Both of my parents worked hard all their lives for someone else, paid their taxes, and trusted that one day in their old age Uncle Sam would take care of them.

As for me, I got a pretty good education, and made more money than my parents, but I still had the same mindset.

In my mind, the only alternative to having a job was to buy or lease some space, hang out my shingle, and offer my expertise.

We only know as much as we can observe from our environment, so flowing into the Self-Employed category was a natural transition for a guy like me.

The downside of that is what Robert Kiyosaki terms The John Wayne Effect, “Where a man’s gotta do what a man’s gotta do” once he gets sick of having a boss.

It’s usually just one man with a lot of responsibilities struggling to keep it all together.

Moving to the Right Side

When moving to the right side of the quadrant, we enter the territory of the Business Owner and Investor.

Now, you might say, “Wait a minute! Isn’t the Self-Employed individual a Business Owner, too????”

I’ll give you a moment to scratch your head over this.

In short, the answer is, yes and no…

The Self-Employed individual technically owns a business, but it is solely a one-man operation.

Even if he has a partner, his partner is in it individually – both only looking out for their own self-interests and mutual benefit.

If the Self-Employed Boss gets sick, the revenue dries up: his employees are out of a job, and his family could end up being up a creek without a paddle.

This is the precarious price of freedom gained by remaining on the left side of the quadrant.

It can be satisfying and involve a lot of hard work, while still remaining just as short-sighted as the Employee who envisions the future benefits of Social Security and a 401K.

The right side of the quadrant involves a gradual shift in thinking rather than a sudden change in station.

The mindset shifts from being the exclusive owner of a business – i.e. owner of a J.O.B. – to thinking like the founder and CEO of a large Corporate entity, similar to Microsoft or Berkshire Hathaway.

Even if you don’t generate nearly as much revenue as they do.

It’s the mindset that counts.

Think of this analogy: it’s like the difference between driving a Ford and owning a factory that produces Fords.

In the first example, you’re only operating one Ford that you own (and probably got into debt to own).

In the second example, you own a self-replicating system that produces an infinite number of Fords.

In the first, you live or die with each sale per customer daily!

In the second, the channel is open for multiple streams of income, while allowing for the natural ebbs and flows of retention and attrition within your customer base, all without skipping a beat in the generation of revenue.

There are also better tax benefits, and the ability to raise greater capital for investments!

No Rich Dad to be Had

Now all that I’ve described and all the examples I gave are easier said than done.

Bill Gates had a Rich Daddy; Henry Ford was a mechanical genius; and Warren Buffett started investing when he was 12.

In the case of Buffett and Gates, by virtue of being born into families that were already on the right side of the quadrant, they had a natural advantage and a ready-made network they could call upon.

So where does that leave the average person just starting out?

The Little Guy’s Way to Big Money

One of the beauties of a Capitalist System is that there are ways for the average guy or gal to build wealth.

Your destiny isn’t fixed anymore now as it was 30 years ago in this country.

Small business opportunities are falling off trees wherever you look these days.

All that’s required is a little bit of diligence and a good mentor.

Just because you don’t come from a wealthy family doesn’t mean you can’t build a wealthy family.

Reinventing the Wheel – Sort of!

Most business opportunities don’t require you to reinvent the wheel…

But they do require you to reinvent yourself!

The quickest and simplest way is by being coachable.

There are people WAAAAY smarter than you who figured this game out a long time ago.

I know it’s tough, because we’re all set in our ways, but it’s the only way to be red-pilled and out of the Matrix for good.

The Franchising Model

The best vehicle for reinvention – without reinventing the wheel – is Franchising.

This model became unique to the Postwar Baby Boom era through McDonald’s.

But the concept of a franchise is nothing new.

It goes back to the Middle Ages when tax collectors had to pay brokerage fees to local landowners for the right to collect in their name.

The basic definition of a franchise is,

A business which pays a mixture of upfront and ongoing fees in order to license the brand name and supporting resources of a parent company. (Investopedia)

Some other working definitions include:

- The right to vote at a public election or referendum;

- A right or privilege officially granted to a person, a group of people, or a company by a government.

- An acknowledgment of a corporation’s existence and ownership.

- The authorization granted by a company to sell or distribute its goods or services in a certain area.

McDonald’s has exported its franchise. - A business operating under such authorization, a franchisee.

- A legal exemption from jurisdiction.

- The membership of a corporation or state; citizenship.

- The district or jurisdiction to which a particular privilege extends; the limits of an immunity; hence, an asylum or sanctuary.

- (sports) The collection of organizations in the history of a sports team; the tradition of a sports team as an entity, extending beyond the contemporary organization.

The Whalers’ home city of Hartford was one of many for the franchise. - (business, marketing) The positive influence on the buying behavior of customers exerted by the reputation of a company or a brand.

- The loose collection of fictional works pertaining to a particular fictional universe, including literary, film or television series from various sources, generally when all authorized by a copyright holder or similar authority.

the Star Wars franchise - Exemption from constraint or oppression; freedom; liberty.

- (obsolete) Magnanimity; generosity; liberality; frankness; nobility. (Wiktionary)

Words carry meaning and significance.

And with all the varied meanings, there is a lot of room to leverage the significance of the venture you want to undertake with a franchise.

Cost-Benefit Analysis

When purchasing a brick-and-mortar franchise, you really don’t have to worry about the success-to-failure ratio.

McDonald’s, Starbucks, Dunkin Donuts, are all pretty much commercial and financial done deals – like falling off a log!

The only downside of it can be exorbitant franchise fees, and a lack of creative decision making for product and storefront policy.

But rather than seeing a downturn, the market predicts an estimated 805,000 franchises in operation in the US for 2023, with an increase of 15,000 new locations from the previous year.

The New Kid in Town

Ok, so you’ve taken all this information in, and are still thinking,

“Great! Now how in the hell do I get started!?”

Very useful question.

There’s so much to choose from in franchise offerings.

Some are tried and true income generators, some require more work to get the word out, depending on location.

At the beginning of this article – if you can slog your way back from all my wordiness – I mentioned that this subject is personal.

Having spent 33 years in the restaurant industry, makes this latest trend in franchising near and dear to me.

This new opportunity is known as “Ghost Kitchens”, or Virtual Restaurants.

Food delivery businesses like Uber Eats and DoorDash have been pretty popular since the 2010s and teens, but they mainly only thrived in overpriced Urban and Suburban areas where food delivery had become passé.

These delivery services became like Spago’s takeout for the working man.

But the Covid Crisis enabled them to become rising stars nationwide, and this spotlight made them the New Kids on The Scene.

And out of all that came the necessity for Ghost Kitchens…

Except for most Big-Box Retail Stores and Supermarkets, the pandemic affected everyone’s bottom line.

But the limited access to goods didn’t affect the desire of the consumer to acquire them, no less than the desire of the business to provide them.

Most mom-and-pop restaurants weren’t set up for delivery, but rather than folding, they got creative!

With the Ghost Kitchen model, restaurants began to partner with delivery service businesses like DoorDash and Uber Eats for use of their kitchen space.

With one convenient pickup location, licensed to prepare and offer all of the established food deliverables, like McDonald’s, KFC, or Subway, it was an ingenious new way of keeping businesses running and consumers satisfied in a time of crisis.

While the pandemic is winding down, Virtual Kitchens are still gaining momentum.

In fact, it’s just getting started, with Walmart getting in on the action of offering its shoppers virtual meal options while they browse through the store.

And it’s becoming the latest franchise opportunity for anyone ready to transition to the business owner side of the quadrant.

What Else Can I Say?

I’ve said a lot…and I’m aware of all the objections you might have over starting your own business or buying a franchise:

Like most of us, you probably don’t have an extra $500K lying around. (The typical franchise fee for a McDonald’s).

Or, you don’t have the necessary support from friends and family to act as motivation.

Maybe you have a family that relies on the salary from your 9-5.

I know, it can be pretty scary and confusing.

I’ve been there myself.

It’s also the reason that I went into business for myself.

I created BBig Financial Solutions to be a guiding light for would-be entrepreneurs like I once was – the guy who doesn’t know what he doesn’t know.

Knowing that there are 27 mistakes that can get you rejected from Business Funding, I could see the handwriting on the wall for where the average American and the Economy is headed.

The future is Ghost Kitchens with the best startup costs for a first timer that wants a guaranteed income through brand recognition.

With BBig Financial Solutions, we can guarantee funding with any venture that you can create a business plan for.

Stop using your talents to make other people rich!

Get started on the life that you only once dreamed of –There’s no guarantee that it will be easy, but it will be more than worth it.

Sources: